SVB and Residential REITs

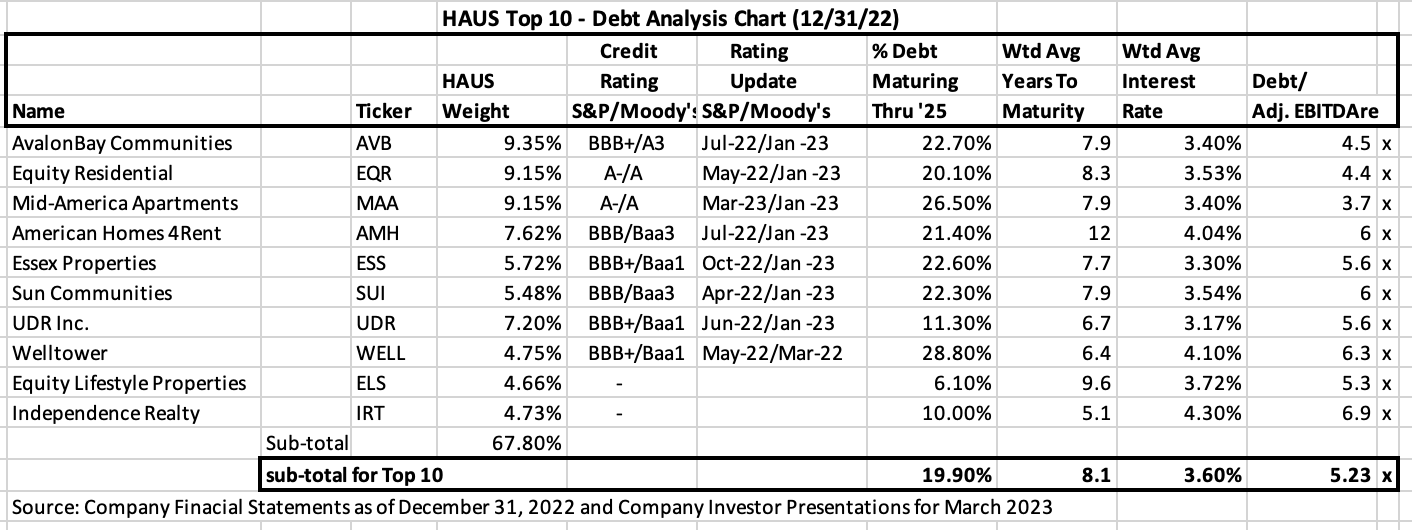

The recent collapse of Silicon Valley Bank (SVB) and the launch of the Federal Reserve’s Bank Term Funding Program (“BTFP”) have sent markets on a roller-coaster ride. Currently, the 10-year treasury yield is hovering around 3.50% coming off its recent 4% level. Recent housing data continues to show signs of home prices moving lower after the ten-year bull market; and sequential asking rents in several major apartment markets has been turning down for the first time since the pandemic-driven reopening of the economy. Today, we are shedding some light on the balance sheet characteristics of the Top 10 holdings (constituting roughly 70% of the total portfolio) within HAUS.

A Reminder

Before we go into depth on the balance sheets, let’s highlight a couple of important facts. First, with the Federal Reserve raising interest rates over the past 15+ months from 0% to 4.50%-4.75% currently and with possible further interest rate hikes on the table, every Wall Street firm is learning how to operate in a new environment. Combine that fact along with 30-year mortgage rates hovering around the 7% level, it shows that home ownership affordability remains out of reach for many would-be buyers. Residential REITs, on the other hand, have highlighted the relatively strong start to 1Q’23 leasing that could provide some tailwinds through the rest of the year. Why? Because tenants continue to pay their rents which means that rental income gets passed through to investors in the form of dividends.

Coastal Apartment Companies

The coastal apartment companies within the Top 10 represent just over 32% of the portfolio and all four names have investment grade credit ratings of BBB+/Baa1 or higher, with Equity Residential (EQR) the highest at A-/A. EQR has just over 20% of its debt maturing through 2025 and 42% of its debt will not mature until 2030 or beyond for a weighted average year- to-maturity of debt in excess of 8.3 years. The weighted average interest rates across EQR’s debt structure was an attractive 3.53% at the end of 4Q22. AvalonBay Communities (AVB) and Essex Property Trust (ESS) both have debt maturity schedules which mirror that of EQR with 22-23% of debt maturing over the next three years and over 40% of the debt load extended out to 2030 and beyond. UDR Inc. (UDR) manages its balance sheet at a bit higher level than its peers with a goal of 5.3x-5.7x consolidated net-debt-to-EBITDA, however its debt maturity schedule is quite conservative with just under 12% of total debt maturing through 2025 and almost 53% of the debt stack extending out through 2030 and beyond. UDR also did an exceptional job of locking in low rates for its longer maturity debt, contributing to a “sector-best” weighted average interest rate of 3.17%. ESS had total liquidity of $1.3 billion at the close of 2022 and a net debt to adjusted EBITDA ratio of 5.6x. ESS has also executed extremely well with the timing of their financings, bringing the weighted average interest rate on their $6.0 billion debt load down to 3.3%.

Sunbelt Apartments

The large sunbelt apartment names in the Top 10 are Mid-America Apartments (MAA) and Independence Realty (IRT) at an aggregate weight of 14% in the portfolio. MAA sets the standard in terms of the most pristine balance sheet amongst the major sunbelt operators with a rating of of BBB+/A-. They are also in the enviable position of ending 2022 with a debt/ebitda multiple of 3.7x and a weighted average interest rate on all debt of 3.4%. IRT has yet to receive an investment grade credit rating as it has grown quickly over the past several years and still utilizes secured financing as its primary source of debt capital. This will change in coming years as the stabilized portion of the portfolio continues to grow and the company opts for more permanent sources of long-term capital. In the interim, debt metrics have been improving rapidly and IRT only has 10% of total debt maturing through 2025.

Manufactured Housing Sector

The manufactured housing sector is well represented within the Top 10 holdings of HAUS with Equity Lifestyle (ELS) and Sun Communities (SUI) aggregating a 10.2% weighting. ELS boasts a rock-solid balance sheet with only 6.1% of total debt maturing through 2025 and this is inclusive of current outstanding borrowings on their line of credit. It is also impressive and noteworthy that 70% of their total debt matures in 2030 or beyond, providing the company with a sector leading 9.6 average years to maturity. The weighted average interest rate on all debt is 3.7% and just over 20% of debt is fully amortizing, further reducing interest rate risk over the next several years. Total debt to adjusted EBITDA as of 4Q22 was 5.3x. SUI is rated BBB/Baa3 and has been one of the more acquisitive companies within our constituent universe over the past two years. As a result, SUI does have a higher percentage of total debt rolling through 2025, at 22.3%. This number is inflated by the $1.8 billion of unsecured revolving credit facilities which matures near the end of 2025. The company also has a large portion of their debt extending out through 2030, at 46%, and thus providing an overall 7.9 years to maturity, which is in-line with peers. The average interest rate across the debt capital stack was 3.5% at the end of 2022 and net debt to EBITDA was 6.0x.

Single Family Rental REITs

American Homes 4Rent (AMH) represents 7.6% of the fund. AMH was recently upgraded to BBB by S&P Global and carries a Baa3 rating from Moody’s. At yearend, AMH held an impressive liquidity position of $1.2 billion, including $69 million of unrestricted cash, $1.1 billion of undrawn capacity on its revolving credit facility. Net debt and preferred shares-to-adjusted EBITDA stood at 6.0x. Total debt of the company stands at $4.6 billion, with 22% maturing through 2025, and almost 77% extending to 2028 or beyond.

Top 10 Positions Anchored By Strong Balance Sheet Positions

In aggregate, the Top 10 positions within HAUS constituted 67.8% of the fund as of March 10, 2023. Eight of the ten constituents are investment grade rated, with the remaining two more oriented towards secured debt financing. The weighted average percentage of debt maturing for these companies over the next three years is 20%, with no company rolling more than 30% of their debt over the next three years, and most comfortably below 20%. The weighted average years to maturity for this group is 8.1 years at a weighted average interest rate of 3.6%. Most companies in our universe have fixed rate debt components of at least 80%, with the remaining 20% being largely attributable to credit facilities and other transitional capital.[1]

To get our REIT commentary delivered directly to your inbox, sign up here.

Footnotes:

[1] Source: Company Financial Statements as of December 31, 2022 and Company Supplemental Packages for Fourth Quarter 2022