Dear Reader,

Imagine that you’re sitting in front of your computer about to execute a trade to buy an ETF. As you pull up the quote you notice two things: 1) the bid/ask spread is wider than a penny per share and 2) you only see 100 shares on the screen for the bid/ask volume.

As you ponder executing your order, you say to yourself ”Why is there only 100 shares offered on the screen when I’m looking to buy more stock and how can I improve on the execution price?”

That is where the relationship with Wall Street’s liquidity providers, trading desks, market makers, and Authorized Participants help ETF issuers as what you see on the surface is only a tiny portion of what is happening behind the scenes (like the iceberg above which is so much bigger below the surface).

According to a recent blog post by American Century, “There is a misperception that new or niche ETFs are inaccessible and trade inefficiently because of their small size, low trading volume and wider spreads. Don’t let low trading volume change your mind if the ETF aligns with your client’s goals. A preferred route is to take advantage of the traders at your custodian’s institutional trade desk. They have direct access to the ETF liquidity providers who will compete for the order flow and provide an efficient execution”

The go on to say, "There is no reason to pass on a well-constructed ETF. Don’t let volume (what `investors can typically see) and a wider spread than a penny sway you from investing in an ETF that you believe will better fit the overall portfolio allocation. We believe the alpha potential over the long term may make up for the spread of the lower-volume ETFs."

* Alpha (α) is a term used in investing to describe an investment strategy’s ability to beat the market, or its “edge.” Alpha is thus also often referred to as “excess return” or “abnormal rate of return,” which refers to the idea that markets are efficient, and so there is no way to systematically earn returns that exceed the broad market as a whole. Alpha is often used in conjunction with beta (the Greek letter β), which measures the broad market’s overall volatility or risk, known as systematic market risk. (https://www.investopedia.com/terms/a/alpha.asp)

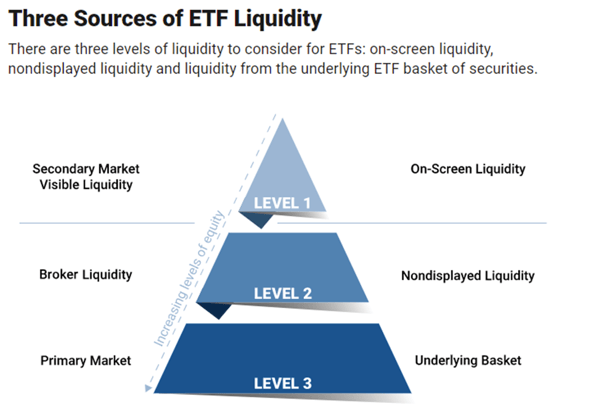

In the above example, the line below Level 1 is the same as the water line in the iceberg picture above. With most of the action happening in Level 3 at the underlying basket level, this is where the ETF create/redeem process happens to ensure that there is liquidity in order to transact in the ETF.

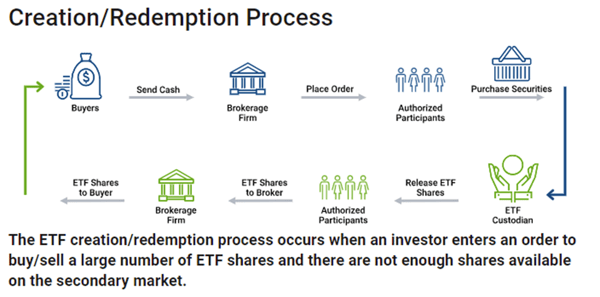

The ETF creation/redemption process is the magic of ETFs. This is what allows new shares of ETFs to be created without moving the market. The process you see above happens behind the scenes through Broker Dealers, Authorized Participants, and the Depository Trust Clearing Corporation (DTCC). This is where the bulk of ETF volume occurs, yet the average investor doesn’t see this transaction in the times and sale history volume of an ETF.

David Mann, Head of Global ETF Capital Markets at Franklin Templeton, recently wrote a blog piece highlighting ETF themes one of which was “an uptick in more nuanced investor questions about using smaller funds given the potential restrictions over percent ownership or assets under management (AUM). Concerns about fund size are often intertwined with questions about ETF liquidity… The takeaway for investors with percent ownership restrictions who are interested in a smaller fund—whether for tax-loss harvesting or as a new investment—is that there might be options available, especially when there is strong collective interest.”

In his original post going back to 2016, David mentions that “Before the first day of trading, typically there is one firm (the seeding counterparty) that delivers the underlying basket to the ETF issuer in exchange for the first ETF shares. This seeding counterparty is often 100% of the fund. If those seeding firms are comfortable owning such a limit, then, in our view, there is no reason any investor should have concerns about the viability of an ETF based on its AUM. What’s more important is to determine how the ETF fits in terms of asset allocation of an investor’s broader portfolio. If an ETF is providing the type of exposure an investor is seeking, he/she should be less concerned about the relative percentage of that ETF’s AUM they account for than with whether the ETF investment is the optimal percentage of their portfolio, given their investment goals.”

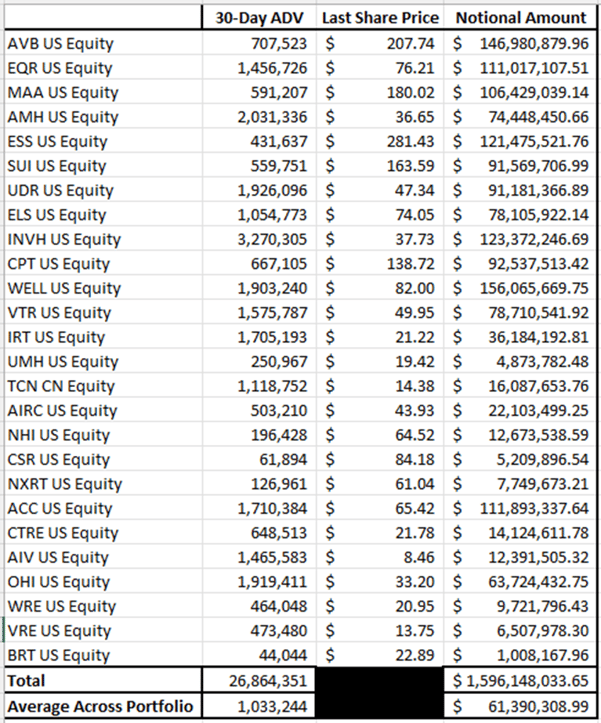

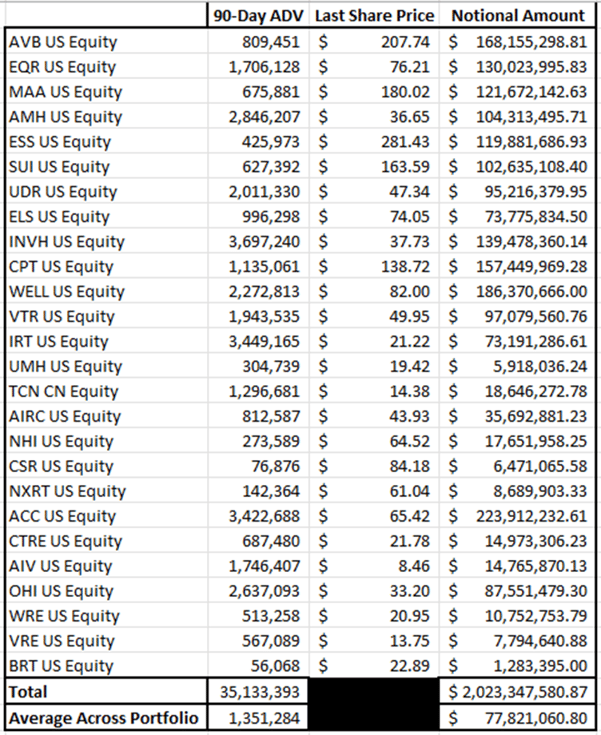

A recent analysis of the Home Appreciation US REIT ETF (HAUS) shows that its 26 constituents have an average 30-day volume of over 1 million shares per day with a net notional amount of $61.3 million. If you expand it out to 90-day volume, then the average daily volume jumps by almost 1/3 to 1.35 million shares per day with a net notional amount of $77.8 million.

If you think about the iceberg picture at the top of the screen, HAUS may only trade a couple of thousands shares per day that the investor sees on the surface, yet the underlying constituents are trading in size which is happening beneath the surface.

American Century: Overlooking Low-Volume ETFs Can Leave Alpha on the Table (May 13th, 2022)

https://www.americancentury.com/insights/overlooking-low-volume-etfs-can-leave-alpha-on-the-table/

American Century: ETFs: Three Levels of Liquidity for Greater Access to the Market (March 24th, 2021)

https://www.americancentury.com/insights/understanding-etf-liquidity/

Franklin Templeton: A Collective ETF Trading Mentality (July 27th, 2022)

https://us.beyondbullsandbears.com/2022/07/27/a-collective-etf-trading-mentality/

Franklin Templeton: ETF Capital Market Desk: Assets Under Management (2016)

https://www.franklintempleton.com/articles-us/liberty-shares/etf-capital-markets-desk-assets-under-management

HAUS Portfolio Data as of August 9th, 2022. Holdings subject to change. A daily list of holdings is available at https://www.armadaetfs.com/haus/.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (800) 693-8288 or visit our website at www.armadaetfs.com. Read the prospectus or summary prospectus carefully before investing.

Investments involve risk. Principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. Brokerage commissions may apply and would reduce returns. The fund is new and has limited operating history to judge.

Fund Risks: The Fund is classified as a non-diversified investment company. The Fund may invest a greater portion of its assets in the securities of a single issuer or a smaller number of issuers than if it was a diversified fund. To the extent that the Fund invests in other funds, a shareholder will bear two layers of asset-based expenses, which could reduce returns compared to a direct investment in the underlying funds.

*The Fund intends to pay out dividends and interest income, if any, quarterly.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (800) 693-8288.

To view the ETF’s holdings and standardized performance, click here. https://www.armadaetfs.com/haus/#haus-holdings

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems, and natural disasters. The Fund may invest in derivatives, which are often more volatile than other investments and may magnify the Fund’s gains or losses.

The Fund may invest in debt securities which are subject to the risks of an issuer’s inability to meet its obligations under the security; failure of an issuer or borrower to pay principal and interest when due; and interest rate changes affect the prices of fixed income securities. In addition, an increase in prevailing interest rates typically causes the value of existing fixed income securities to fall and often has a greater impact on longer duration and/or higher quality fixed income securities.

Unlike typical exchange-traded funds, there are no indexes that the Funds attempt to track or replicate. Thus, the ability of the Funds to achieve its objectives will depend on the effectiveness of the portfolio manager. In general, ETFs can be tax efficient. ETFs are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are generally minimized for the holder of the ETF. An ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying portfolio. However, capital gains tax may be incurred by the investor after the ETF is sold.

Investment Objective: The Home Appreciation U.S. REIT ETF (the “Fund”) seeks total return.

Distributed by Foreside Fund Services, LLC.

Launch & Structure Partner: Tidal ETF Services.