Air Communities Property Tour Summary

We had the pleasure joining AIR Communities Inc. (Ticker: AIRC) on a November 17th, 2022 property tour in Redwood City (San Francisco), CA following the National Association of Real Estate Investment Trust REITWorld Conference.

In its San Francisco/San Jose portfolio, AIRC has 8 multifamily communities comprised of 2,077 apartment homes. The company notes that they have zero exposure to San Francisco’s Central Business District (CBD).

Across its San Francisco/San Jose portfolio, the median household income is $315,000. As of November 14th 2022, the local portfolio was 97.4% occupied and experienced 3Q’22 NOI Growth of 9.5% and a 73.5% operating margin.

On the tour, we visited 2 properties: 707 Leahy and Indigo

The 2 properties are very different and located approximately a mile apart from each other.

707 Leahy was what you typically think of when you hear the term “apartment property” while Indigo struck us more as a high rise/hotel apartment style property.

Both offer completely different views of the area along with different property layouts and pricing to attract potential residents from within the area.

The typical Redwood City renter would be professionals and faculty at Stanford University along with employees and executives from many of the bioscience/medical/tech firms that have a sizeable office presence in the area.

In their research note published on November 18th, 2022 titled “I Left My Heart (Hope) in SF: Key Takes from NAREIT”, Mizuho analysts Haendel St. Juste and Barry Luo wrote the following about the property tour:

■ Concessions in the area were 4-6 weeks. One competitor building <90% occupancy in lease-up is offering 8 weeks of concessions and $2500 cash bonus.

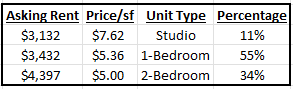

■ 707 Leahy - 94.5% occupied (7 available units) with no concessions but slight reductions in asking rent, ~$3,600 or $5.27/sf, currently comparable to market average rent. Strong tenant profiles with 33 average age, $210K average income, 4.5x in place rent-to-income, 640 minimum FICO score (720 for guarantors), and large mix of tenants in biotech/healthcare. Not yet in same-store pool.

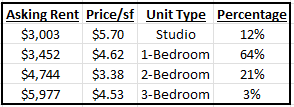

■ Indigo - 95.7% occupied (11 available units) with 4 weeks concessions, ~$4,100 or $4.51/sf. October new/renewal/blended of 9.0%/11.0%/10.4%, and more exposure to tech. No major disruptions from tech freeze yet but starting to see some early signs of increased risk in lease termination.

707 Leahy

From the investor presentation, 707 Leahy was developed in 1973 and redeveloped in 2020 though AIRC acquired the property in 2007. It has 110 units where the average unit size is 694 sf. The average age of its residents is 33 years old with a median household income of $207,000. The current income to rent ratio at the property is 3x while the typical average is 4.5x.

On a tour with its property management, they noted that the property has a blended net operating income (NOI) growth rate of 12.2% while renewals are at 17.2%. In order to ensure they have the appropriate residents, the company pre-screens its prospective tenants and a high FICA score is required. They also noted that it will take them 5 leases to get to 98% occupancy (and currently sit around 94.5%).

Property Amenities include:

- Fitness Center

- Pool

- Outdoor Gym

- BBQ Area

- Pet-Friendly Dog Park

- Smart Home Technology

- Electric Car Charging Station

- Tech Lounge

- Close Proximity to the Train

Indigo Apartments

Per the investor presentation, Indigo Apartments was developed and acquired in 2016. It has 463 units where the average unit size is 842 sf. The average age of its residents is 33 years old with a median household income of $211,000.

On a tour with its property management, they noted that the property has a blended NOI rate of 10.4% while renewals are at 11.0%. They also noted that it will take them 11 leases to get to 98% occupancy (and currently sit around 95.7%).

* Note that Penthouse Level rents range from $3578-$3900/month

* Note that Penthouse Level rents range from $3578-$3900/month

Property Amenities include:

- Fitness Center

- Pool & Spa

- BBQ Area

- 18,000 sf Amenity Deck w/ Outdoor TV

- Pet-Friendly Dog Park

- Conference Room

- Smart Home Technology

- Electric Car Charging Station

- Package Lockers

707 Leahy Website: https://www.live707leahy.com/

Indigo Website: https://www.indigoapthomes.com/

AIRC November Investor Presentation: https://s201.q4cdn.com/375981130/files/doc_presentation/2022/11/AIR-Investor-Presentation_November-2022_vFinal.pdf

Disclosures:

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (800) 693- 8288 or visit our website at www.armadaetfs.com. Read the prospectus or summary prospectus carefully before investing.

Investments involve risk. Principal loss is possible

Distributed by Foreside Fund Services, LLC.