“I skate to where the puck is going” – Wayne Gretzky

As managers of an active Residential REIT ETF, we analyze where people are migrating across the country. The demographic trends and reports are instrumental as we shape the portfolio to try and focus on these key locations.

By combining data from RealPage, Redfin, Zillow, U-Haul, our underlying constitutents, and more, we can exploit migration trends and predict which Residential REITs should benefit from this relocation.

For example, in their press release dated January 3rd, 2023, U-Haul noted that “Texas, Florida and the Carolinas were the preferred destinations of one-way U-Haul® truck customers during 2022, ranking as the top growth states on the annual U-Haul Growth Index.”

The story continues to note that “Texas is the No. 1 growth state for the second consecutive year and the fifth time since 2016. Florida, which ranks second, has been a top-three growth state seven years in a row. South Carolina, North Carolina, Virginia, Tennessee, Arizona, Georgia, Ohio and Idaho round out the top 10 growth states. Virginia and Alabama are the biggest risers, climbing 26 spots from their respective 2021 rankings. New York, Massachusetts, Michigan, Illinois and California are the bottom five states for growth in 2022.”

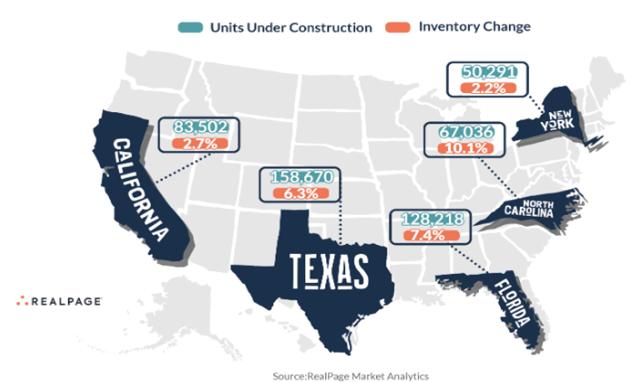

According to RealPage, “The five states with the largest number of apartments under construction as of 3rd quarter 2022 include Texas, Florida, California, North Carolina and New York. Combined, these markets are building 45% of the nation’s apartments.”

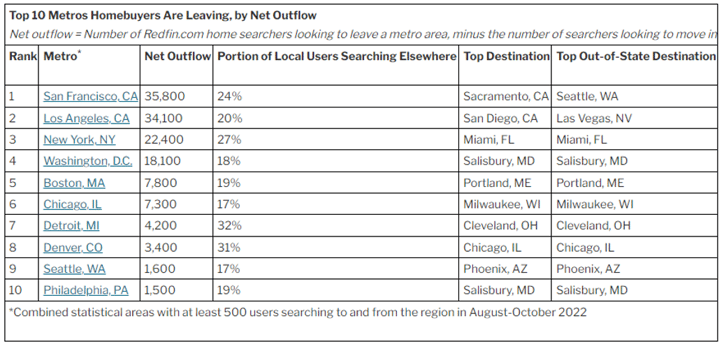

In a report from September 2022, Redfin reported that “More homebuyers left the Bay Area than any other metro in July and August. That’s determined by net outflow, a measure of how many more Redfin.com users looked to leave a metro than move in. Next come Los Angeles, New York, Washington, D.C. and Boston, all expensive job centers highly populated by remote workers with the flexibility to relocate. Migration out of four of those five places–Los Angeles, New York, Washington, D.C. and Boston–increased from a year earlier. That’s partly because of high mortgage rates and economic woes, including inflation, making it more difficult to afford homes in those places. The number of homebuyers looking to move out of the Bay Area declined, likely because it’s one of the only parts of the U.S. where home prices are dropping year over year, giving buyers in the perennially expensive area a bit of relief. Prices fell 8% year over year in San Francisco, 1.6% in Oakland and 0.2% in San Jose.”

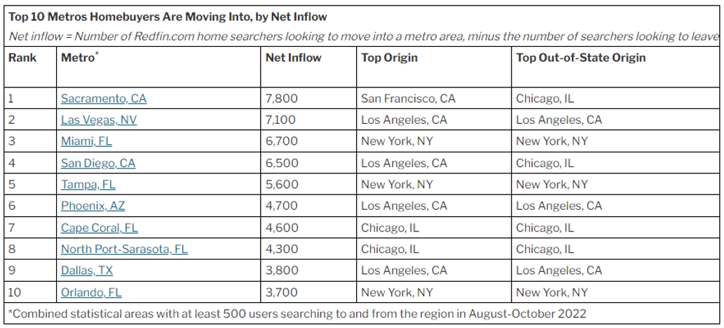

In that same story, Redfin notes that “Miami was the most popular migration destination, continuing a year-plus streak of the South Florida metro taking the number-one spot. Popularity is measured by net inflow, or how many more Redfin.com users looked to move into an area than leave. Next come two California metros: Sacramento, perennially popular for homebuyers moving from one metro to another, and San Diego, which only recently jumped onto the list of most popular destinations. Las Vegas and Tampa, FL round out the top five. They’re followed by Phoenix, Cape Coral, FL, North Port, FL, Portland, ME and San Antonio, TX.”

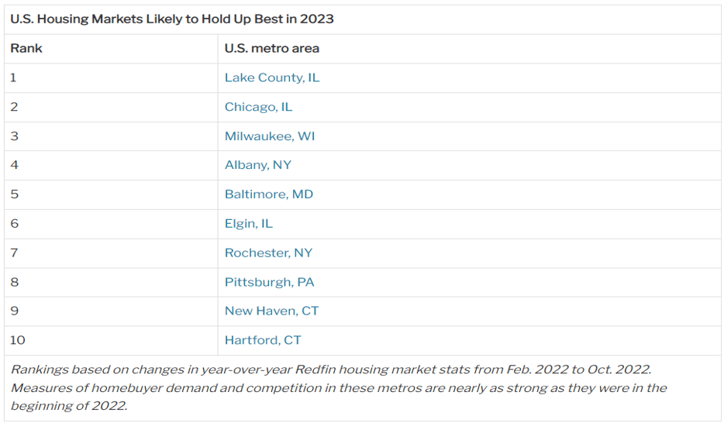

In its 2023 Housing Markets Predictions note, Redfin reports that “Housing markets in relatively affordable Midwest and East Coast metros, especially in the Chicago area and parts of Connecticut and upstate New York, will hold up relatively well, even as the U.S. market cools. Those areas tend to be more stable than expensive coastal areas and they didn’t heat up as much during the pandemic homebuying frenzy.”

In addition, “On the other end of the spectrum, we expect prices to fall most in pandemic migration hotspots like Austin, Boise and Phoenix, largely because the huge increases over the last two years leave a lot of room for prices to decline. Expensive West Coast cities are also likely to see outsized price declines because of stumbling tech stocks and the shift to remote work pushing so many people out of those markets.”

Redfin also predicts that they “…expect the share of Americans relocating from one metro to another will slow to about 20% in 2023, down from 24% this year. That’s still above pre-pandemic levels of around 18%.”

In November 2022, Redfin reported that “Nearly one-quarter (24.1%) of U.S. homebuyers looked to move to a different metro area in the three months ending in October. That is on par with the record high of 24.2% set in the third quarter and up from roughly 18% in 2019, before the pandemic ushered in the remote-work era that gave many Americans more flexibility to relocate.”

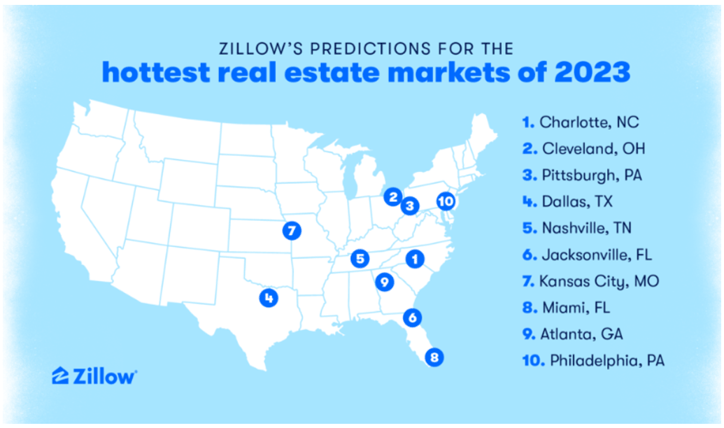

According to Zillow’s 2023 estimates, they expect “Charlotte to be the nation’s hottest housing market in 2023, with Cleveland, Pittsburgh, Dallas, and Nashville filling out the top five.”

In the report, they note that “Zillow’s list of the hottest markets in 2023 is based on an analysis of forecast home value growth, recent housing market velocity and projected changes in the labor market, home construction activity and number of homeowner households. Pushing Charlotte to the top of the list is its forecasted annual home price growth, and Cleveland’s second-place rank can be attributed to its high market velocity and job growth. While Pittsburgh is the only market in the top five with forecasted household declines, it makes up for the drop in owner-occupied homes with the fourth-highest ratio of jobs added per new home permitted. The coolest markets of the year are expected to be San Jose, Sacramento, Minneapolis, and Denver. Each of these is characterized by expected annual home value declines and slower housing market velocity – as measured by total listing days on market – than other large markets.”

Near-Term Supply Outlook

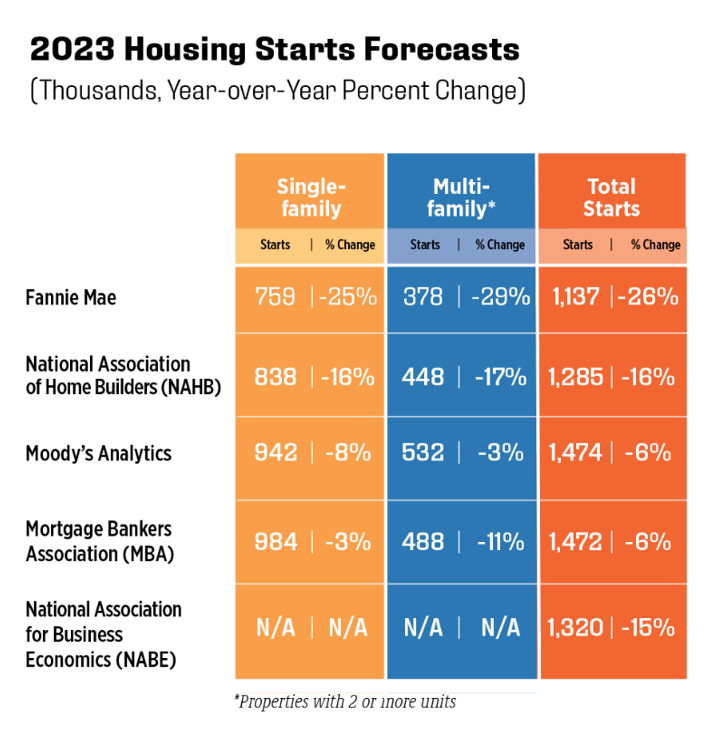

According to the National Apartment Association (NAAHQ), “Multifamily construction fundamentals are expected to weaken, which makes sense since by most private sector measures, 2023 will be a decades-high year for new completions.”

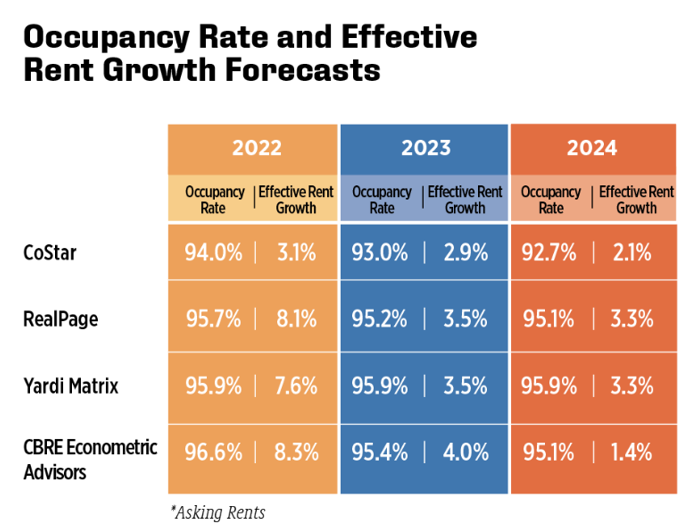

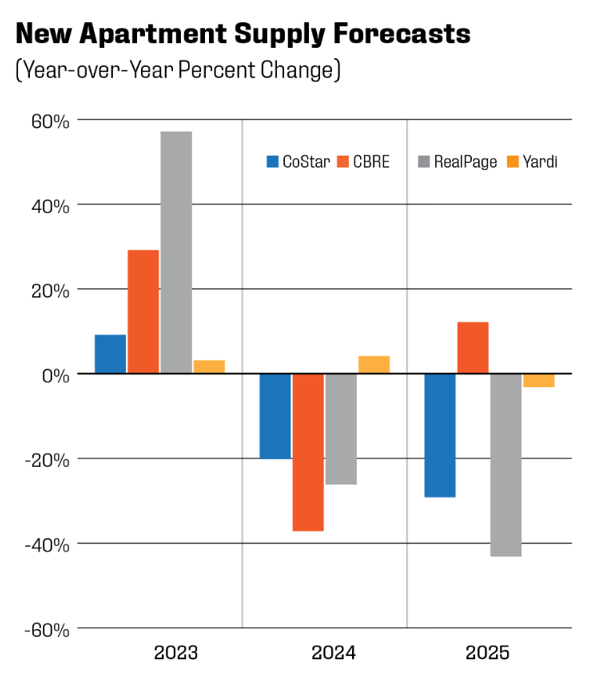

NAAHQ also reported that “Both RealPage and Apartment List reported three consecutive decreases in rents from September through November. Apartment List average national rents declined by 1.0% in November, a larger drop than during the pandemic lockdowns. According to the Census Housing Vacancy Survey, new renter household formation declined in the second and third quarters by a total of 577,000, but this comes on the heels of a post-pandemic boom, which saw an additional 3.4 million renter households. As inflation, including rent growth, has continued to outpace wage growth, layoffs take hold in some industries and economic uncertainty prevails, renters are pausing on making moves and have begun to combine households for cost savings. Occupancy rates are projected to decrease through 2024, although remain near historical averages. Effective rent growth returns to longer-term norms in 2023, ranging between 2.9% and 4.0% and moderates further in 2024, ranging from 1.4% to 3.3%. The peak supply year coupled with a decline in starts in 2023 results in fewer units being delivered in 2024 and 2025, which will help bring supply and demand into balance in the aftermath of a downturn.”

Looking at the future supply outlook, NAAHQ shows:

What Does It All Mean?

We are focused on where the puck is going.

When looking at the investor presentations from some of the largest Apartment REITs, we can analyze where their portfolios are growing and which markets are capturing the most growth.

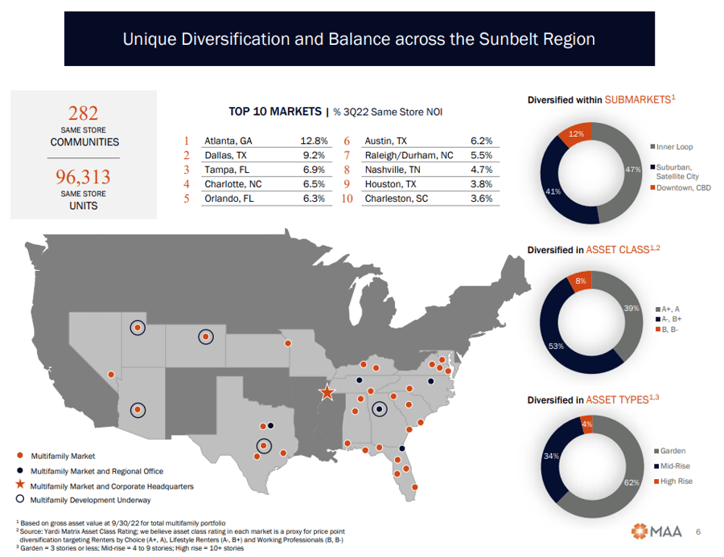

In MAA’s NAREIT Investor Presentation, the company presents an interesting slide highlighting their portfolio and outlook:

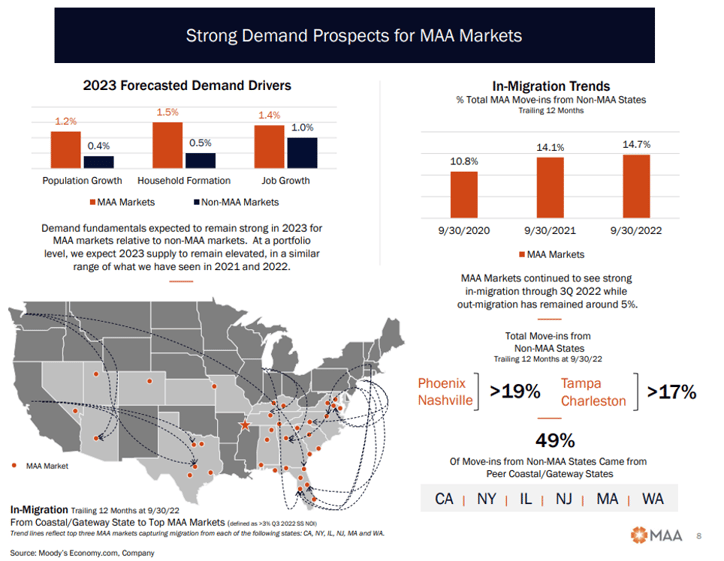

Plus they also provide an analysis of migration trends across their portfolio:

For those unaware, MMA top markets are:

- Atlanta, GA

- Dallas, TX

- Tampa, FL

- Charlotte, NC

- Orlando, FL

- Austin, TX

- Raleigh/Durham, NC

- Houston, TX

- Nashville, TN

- Charleston, SC

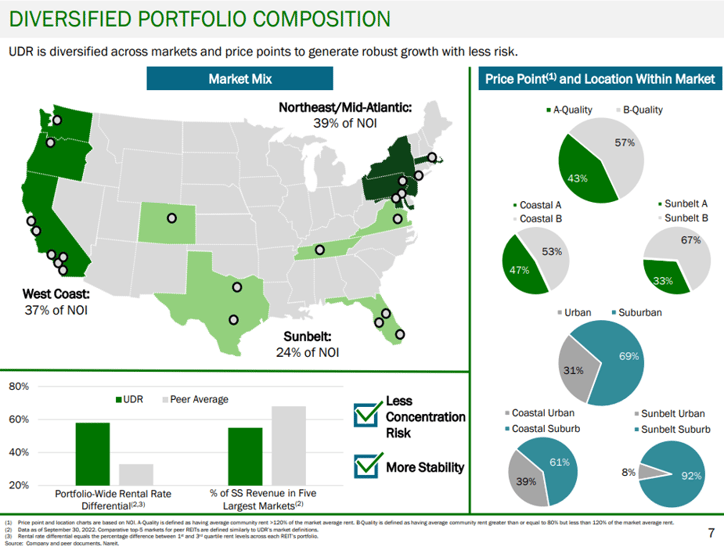

When looking at UDR’s November NAREIT presentation, they highlight the company “ is diversified across markets and price points to generate robust growth with less risk.”

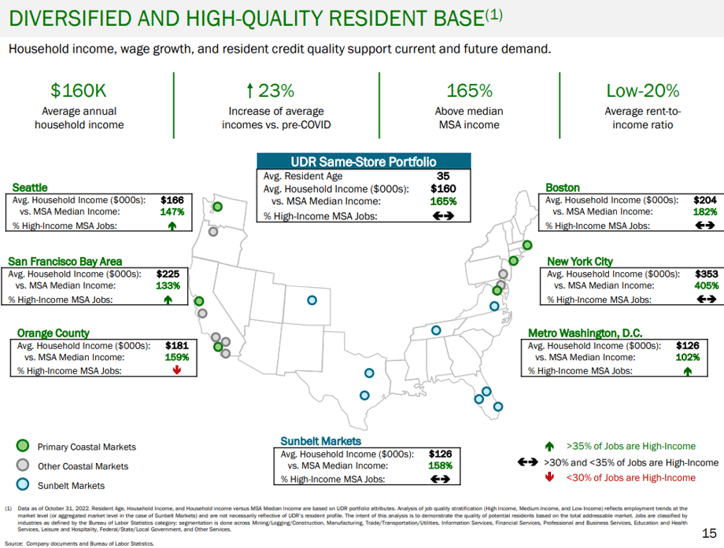

Looking at their tenant base and demographics, they highlight household income and wage growth with supports current and future demand:

The headlines in the news focus on rising interest rates, inflation and potential recession on the horizon.

Our focus is on the fundamentals and capturing rent growth by incorporating these demographic trends into our investment process.

Definitions:

Net Operating Income (NOI) is a formula those in real estate use to quickly calculate profitability of a particular investment. NOI determines the revenue and profitability of invested real estate property after subtracting necessary operating expenses.

Metropolitan Statistical Area (MSA) are U.S. government designations for specific urban areas.

Footnotes:

U-Haul Growth States of 2022: Texas, Florida Top List Again: https://www.uhaul.com/Articles/About/U-Haul-Growth-States-Of-2022-Texas-Florida-Top-List-Again-28337/

These Five States Are Building the Most Apartments: https://www.realpage.com/analytics/these-five-states-are-building-the-most-apartments/

A Record Share Of Homebuyers Relocate, Driven By Moves Away From Expensive Coastal Areas: https://www.redfin.com/news/august-2022-housing-migration-trends/

Housing Market Predictions 2023: A Post-Pandemic Sales Slump Will Push Home Prices Down For The First Time In A Decade: https://www.redfin.com/news/housing-market-predictions-2023/

Redfin Reports Homebuyers Are Looking to Relocate to Affordable Areas–Especially in Florida–Amid High Rates, Prices: https://investors.redfin.com/news-events/press-releases/detail/841/redfin-reports-homebuyers-are-looking-to-relocate-to

Why Charlotte Will Be 2023’s Hottest Market: https://www.zillow.com/research/2023-hottest-market-31982/

MAA November 2022 NAREIT Investor Presentation: https://s1.q4cdn.com/498755859/files/doc_presentations/2022/NAREIT.NOV.2022.Final.pdf

UDR November 2022 NAREIT Investor Presentation: https://s27.q4cdn.com/542031646/files/doc_presentations/2022/11/UDR-November-2022-Investor-Presentation.pdf

National Apartment Association 2023 Apartment Housing Outlook:

https://www.naahq.org/2023-apartment-housing-outlook